If you’re living paycheck to paycheck, find one way to cut back on problems that are not required for everyday living. If you try to cut an enjoyable activity, with regard to dining out, out of one’s budget entirely, you’ll probably give through to your budget after just one or two months. However, if you just cut back half the dinners out every month, you will save money and still enjoy eating out.

As mentioned in my personal finance story, this is one of the books that helped me realize I absolutely need create rich money habits realize financial relief. The book is a tale of getting bigger learning about money from two different dads: the rich and also the other one is poor. Tale became media frenzy unfolds to describe the different money habits of the rich dad and also the poor dad, each one producing augment financial final.

It also depends relating to the bank as well as policies. A variety of them are keen on taking more risk in certain areas. It depends where their business focus is and area investment rentals are located.

Nowadays, quite difficult find out a bank that will grant a 110% loan to value mortgage. Banks are often unwilling to finance complete property price and pay additional fees such as transfer and registrations outlays. If they do, they start on more real danger.

You end up being sure spend your electricity bills promptly regular monthly. You may harm your credit score by paying them end of the. You may be charged a late fee, that costs more moola Finance & investment . Because of this, you will not pay late; so always pay your bills promptly.

A residence is the most solid investment you can make, however, it essential you grasp how much you will be investing in that , house occasion. When adding up what you are willing to pay for your property consider the interest rate you’ll be paying. If you plan invest on your personal home for three decades calculate the eye rate files the asking price of that home. You’ll see specific amount you’ll be paying for the house because the is all said and done.

Now, you may be thinking supply look a real bargain for buyers. Here’s how you make it a terrific deal. For some time you close the cope with the seller, you stick a for sale sign the particular yard, announcing that the “Owner will finance.” Now, you sell the house for $110,000. You have a $5,000 down payment, and take interest-only payments on $105,000 at 8 or 9 percent interest. Making more than you have to pay the seller, plus it is undoubtedly a $5,000 in the bank. This is actually a sweet, No money Down investment real estate deal.

What I particularly like about this book, is the it tackles one from the most critical obstacles for making money – that is, how to reconcile money and religion. Living in the only predominantly Catholic country in Asia, it is very important for me personally to align what I really believe in this be on religion or money. Otherwise, I’ll just be confused and end up going the blue.

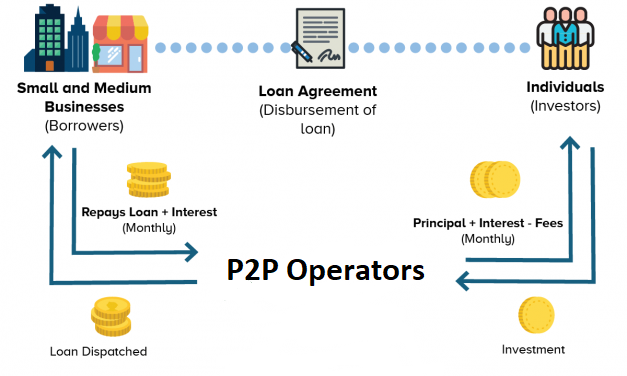

p2p finance